FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

As the April 15th tax filing deadline approaches, taxpayers still have an opportunity to reduce their taxable income and potentially lower their tax liability. Implementing strategic tax-saving moves before filing can maximize deductions and credits, while keeping more money in the taxpayer’s pocket. Although most strategies to reduce income must be completed by December 31st, there are a handful of effective strategies available to implement before April 15th.

Contributions to tax-advantaged retirement accounts can lower one’s taxable income. Fortunately, contributions to these types of accounts are available until the tax filing deadline, April 15th, to count towards the previous tax year.

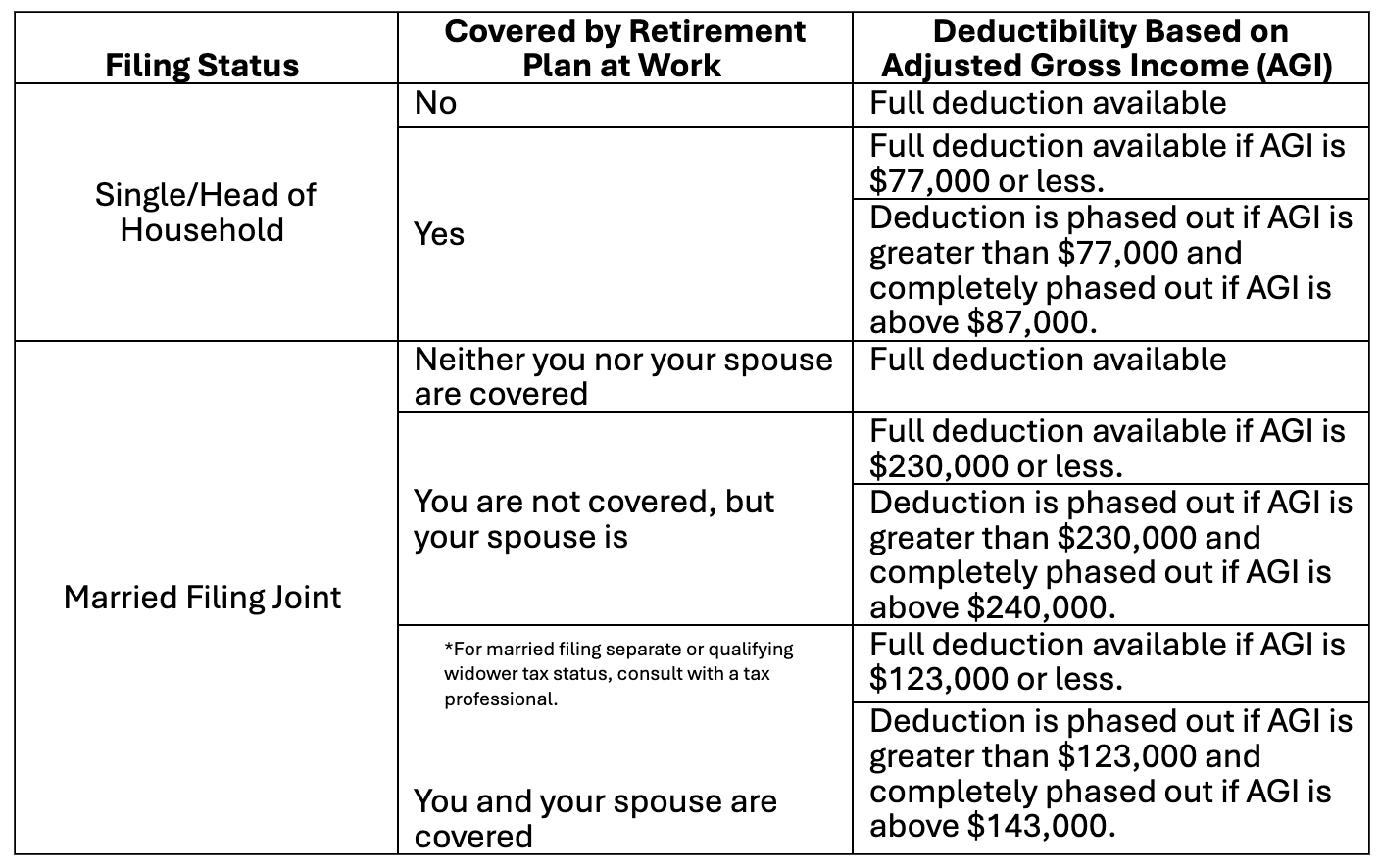

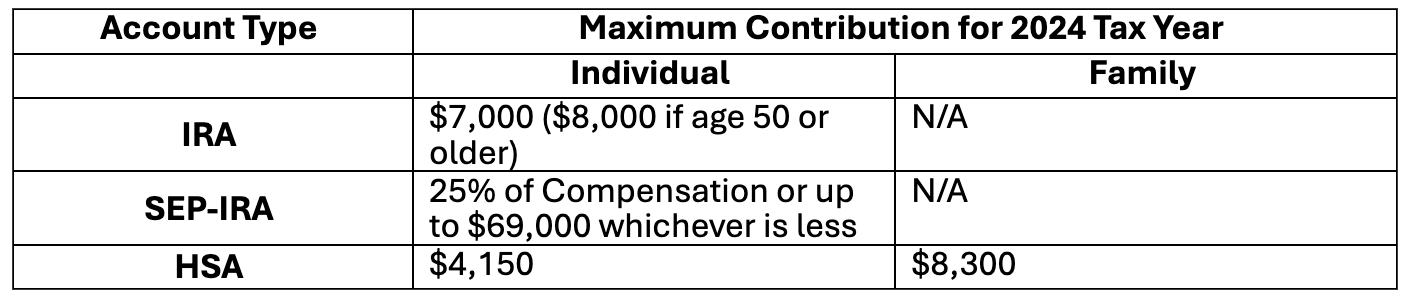

Traditional IRA: In order to contribute to an IRA, one must have taxable income. For the 2024 tax year, individuals can contribute up to $7,000 ($8,000 for individuals aged 50 or older). It’s important to note that there are specific deductibility rules on contributions that heavily relate to income limits and whether the taxpayer is covered under an employer retirement plan. Below is a table to show the deductibility status for 2024:

Spousal IRA: Generally, one must have earned income to contribute to an IRA. However, if one’s spouse does not have earned income or has inadequate income, their IRA can be funded based on the higher earner if a joint tax return is filed. There are other rules around funding an IRA for a spouse, so it’s important to seek guidance from a tax professional before contributing to a spousal IRA.

Sep IRA: Small business owners or self-employed individuals may fund a Simplified Employee Pension (SEP) IRA plan to save for retirement. This type of plan is funded only by the employer (the employee is not allowed to contribute), and the annual contribution limits are substantial. For the 2024 tax year, an employer may contribute 25% of one’s compensation or up to $69,000 whichever is less (the limit increased to $70,000 for the 2025 tax year). Additionally, contributions are tax-deductible for the employer and offer an opportunity to significantly reduce tax liability. Contributions to a SEP IRA may be deposited up to the time the taxpayer files their federal income tax return for that year, including during an extension period. For example, a small business owner or self-employed individual has until April 15th (S Corps and Partnerships have until March 15th) or if an extension is filed, up until the end of the extension period to contribute to the SEP plan. There are additional rules regarding SEP IRA plans, one should seek guidance from their financial advising team and trusted CPA.

Under a high-deductible health plan (HDHP), individuals have the opportunity to make pre-tax contributions to a Health Savings Account (HSA). The contribution limit for 2024 was $4,150 for an individual plan and $8,300 for a family plan. HSA account owners have until the tax filing deadline to maximize the annual contribution. Maximizing a Health Savings Account (HSA) is a smart way to save on taxes while building a fund for medical expenses. Furthermore, HSAs offer many tax benefits: contributions are tax-deductible, growth is tax-free, and distributions for qualified medical expenses are also tax-free. This is a great tool to not only reduce taxable income but save for future medical costs.

Now is the time to take full advantage of implementing these few strategies to help reduce taxable income for the 2024 tax year. Consult with a CPA and financial team to ensure compliance with IRS regulations, determine what types of contributions are available, and what works best for the overall financial picture.

Martha had always been careful with her money. At 78 years old, she prided herself on being independent and managing...

Saving is an essential part of financial health, but if all you do is save, you could be missing out...

Austin, Texas is flourishing, boasting one of the nation’s most dynamic and resilient economies. Known for its innovative spirit, the...

Fort Worth, Texas continues to evolve as a powerhouse in the commercial landscape, offering both established businesses and new ventures...